Debt Investors

Centrica’s Treasury department exists to ensure that the Group’s financing needs are met, to maintain the Group’s liquidity position and credit rating agency relationships, and to manage key financial risks such as interest rate and foreign exchange risk.

The function prioritises reduction of risk in these areas. The financial strategy is designed to be prudent, consistent with the overall business strategy and flexible to respond to sudden unexpected changes in the economic environment.

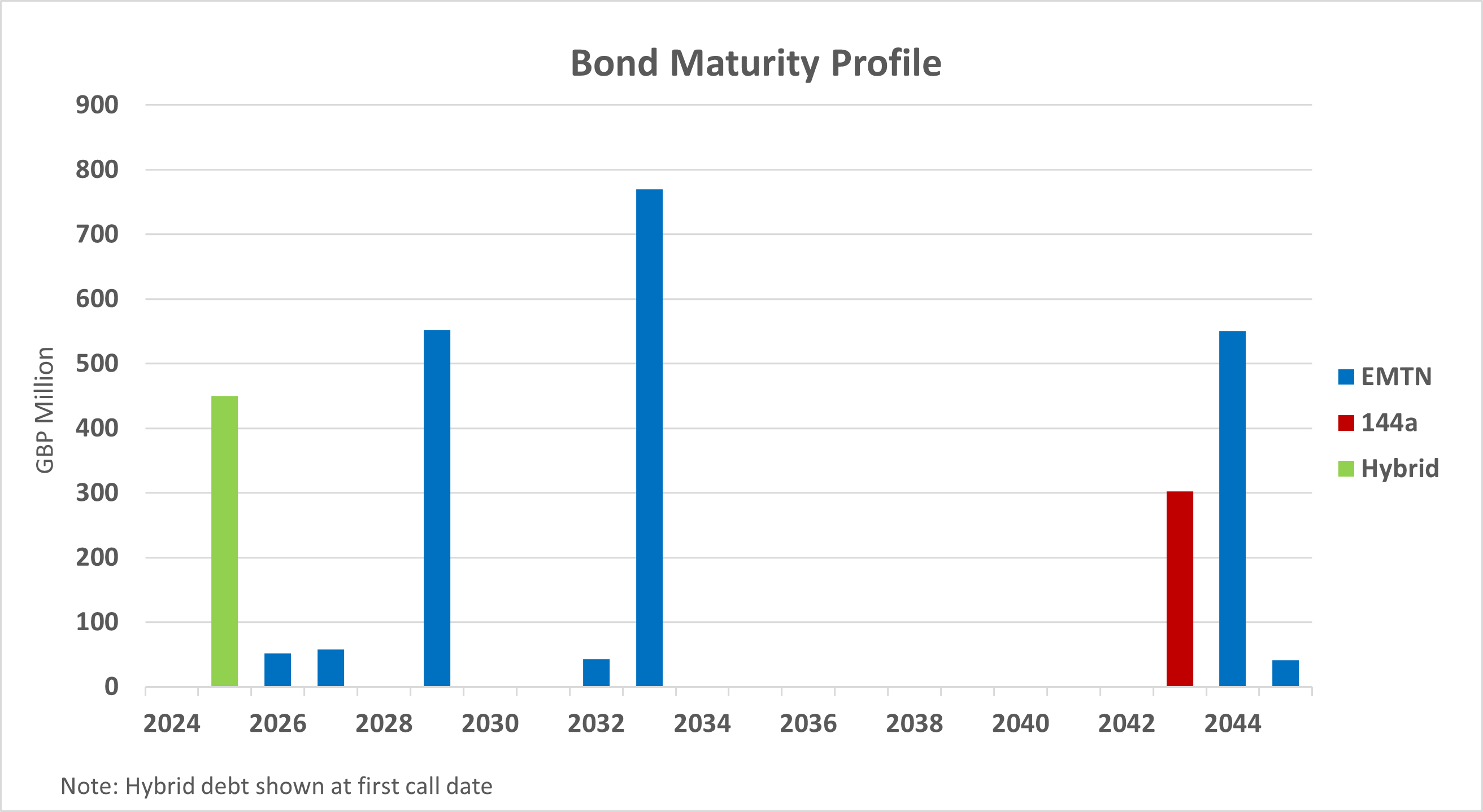

Our debt needs are met through a combination of capital market and bank financings. In the capital markets we have a $10bn Euro Medium Term Note Programme (EMTN) under which a number of benchmark sized sterling bonds and some smaller private placements have been issued. In addition, we have $670m of US 144a bonds, and £450m of hybrid capital outstanding. We also utilise a $3bn US Commercial Paper Programme. View our latest EMTN prospectus or the offering circular for our 144a bond. Bank finance is primarily sourced from a large group of relationship banks that also provide a significant level of committed back up lines. The combination of these facilities provides the prudence and flexibility which are key to the financial strategy.

Credit investors are important to Centrica. We see the sterling and US markets as being central to the Group’s financing.

We do understand that our debt holders would appreciate a point of contact on developments that could influence credit analysis. Please take the opportunity to contact the treasury team at the email address below, if you have any specific query. The team would also appreciate any feedback on how we can best keep you informed in the future.

Email: debtinvestor@centrica.com

Documents

- 03/07/2023 Euro Medium Term Note Programme Prospectus(PDF – 1.3mb)

- 14/10/2013 US$ Senior Note Programme(PDF – 6.5mb)

Senior unsecured: long/short term ratings

Centrica’s treasury team maintains frequent contact with Moody’s Investor Service (Moody’s) and Standard and Poor’s (S&P) to ensure that the agencies are kept informed of significant developments in the Group.

Senior members of Centrica’s management team also meet with these agencies formally, usually at least once in each financial year, to discuss strategic plans and the anticipated performance of the Group.

|

Moody’s |

S&P |

|

|

Lead analyst |

Joanna Fic, Tel: +44 (0)20 77725571 |

Julien Bernu, Tel: +44 (0)20 71767137 |

|

Centrica plc |

Baa2 (s) / P-2 (s) |

BBB (s) / A-2 |

|

British Gas |

NR |

BBB (s) / -- |

|

Last published |

14/12/2021 |

15/12/2021 |

Key:

(s) - stable outlook

(n) - negative outlook

NR - not rated

| Currency | Maturity | Notional Principal | Coupon (%) | Issue Date | Download |

|---|---|---|---|---|---|

|

GBP |

2026 |

51,650,000 |

6.400% |

£150m 04 Sep 2006 |

|

|

USD |

2027 |

70,000,000 |

5.900% |

16 Apr 2010 |

|

|

GBP |

2029 |

552,110,000 |

4.375% |

13 March 2012 |

|

|

EUR |

2032 |

50,000,000 |

Zero Coupon (4.2% Accrual Yield) |

05 Jan 2012 |

|

|

GBP |

2033 |

770,000,000 |

7.000% |

£450m 19 Sep 2008 |

|

|

USD |

2043 |

366,880,000 |

5.375% |

11 Oct 2013 |

|

|

GBP |

2044 |

550,000,000 |

4.250% |

£500m 12 Sept 2012 |

|

|

GBP |

2075 |

450,000,000 |

5.250% |

8 April 2015 |